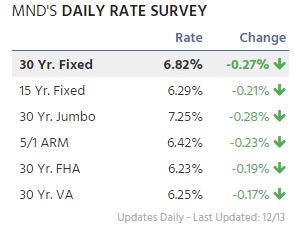

Christmas Came Early!!! Interest rates are at 6.82%! My oh my!

The housing market has undergone a significant transformation since the beginning of 2021. A period of remarkable growth, fueled by historically low interest rates, peaked in October 2022 with a 27% increase in median sales price (FRED data). However, the tide began to turn as the Federal Reserve responded to rising inflation and prices by aggressively increasing interest rates.

This swift climb, from 5% to 7% in just three months, has demonstrably impacted the market. While sales prices have remained relatively stable throughout 2023, days on market have significantly increased by over 50%. One key factor contributing to this slowdown is the reluctance of homeowners with low-interest mortgages to sell, leading to a decline in existing home sales.

While earlier projections anticipated a decline in interest rates to the 6% range in 2024, this scenario has already materialized. Furthermore, the Federal Reserve has indicated the possibility of three additional rate cuts this year. This presents an advantageous window for buyers who have been waiting for more favorable market conditions. It is important to recognize, however, that this window may not remain open indefinitely.

Conversely, sellers may find the spring season to be a more opportune time to list their properties. Anticipated market conditions in the new year, including lower interest rates and increased inventory, suggest that spring could offer a more competitive selling environment.

The housing market in 2024 is expected to be characterized by lower interest rates and a more balanced inventory situation. While this presents opportunities for both buyers and sellers, careful consideration of market dynamics and individual circumstances is crucial for navigating this dynamic landscape.

Thanks for reading,

Chris