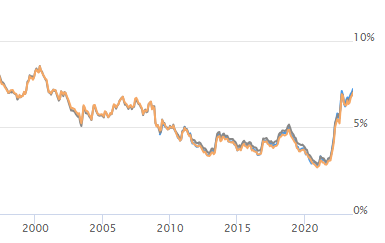

The mortgage rates have been rising steadily in recent months and have reached the peaks we were seeing in 2000. This is having a significant impact on the housing market.

For home buyers, higher rates mean higher monthly mortgage payments. This can make it more difficult to afford a home, especially for first-time buyers. However, there is one silver lining for buyers: the higher rates are also leading to a decrease in demand, which gives buyers more flexibility in negotiating terms of a deal and asking for concessions from sellers.

For sellers, higher rates can be a double-edged sword. On the one hand, rising home prices mean that sellers can still sell their homes for a profit. However, on the other hand, higher rates can make it more difficult to find buyers, as fewer people can afford to purchase a home. Additionally, sellers who bought or refinanced during times of low interest rates may be giving up their low interest rate when they sell their home, which could mean higher monthly payments for them as well.

Overall, the impact of high mortgage rates on home buyers and sellers is mixed. Buyers have more flexibility in negotiating terms, but they also face higher monthly payments. Sellers may be able to sell their homes for a profit, but they may also have a harder time finding buyers.

Here are some tips for home buyers and sellers in a market with high mortgage rates:

- For buyers: Be prepared to pay higher monthly mortgage payments. Be realistic about your budget and don’t overextend yourself. Be prepared to negotiate terms of a deal and ask for concessions from sellers.

- For sellers: Be patient. It may take longer to sell your home in a market with high mortgage rates. Be prepared to lower your asking price if necessary. Consider paying cash for your next home if you can afford it, so you don’t have to take out a mortgage with a higher interest rate.

The housing market is constantly changing, and it’s important to stay up-to-date on the latest trends. By understanding how high mortgage rates are impacting the market, you can make informed decisions about your own home buying or selling plans.

Thanks for reading,

Chris