The ever-widening gap between U.S. median house prices and median income is a pressing issue that affects millions of Americans. Over the past few decades, we’ve witnessed a significant divergence: while house prices have soared, wages have stagnated, adjusting for inflation. This disparity has made homeownership an increasingly elusive dream for many, particularly for first-time buyers and middle-class families.

The roots of this problem are multifaceted, involving factors like supply constraints, zoning laws, and the influx of investment in residential real estate, which have all contributed to the skyrocketing prices. On the other side of the equation, wage growth has not kept pace. The result is a housing affordability crisis that threatens the economic stability and well-being of countless individuals and communities.

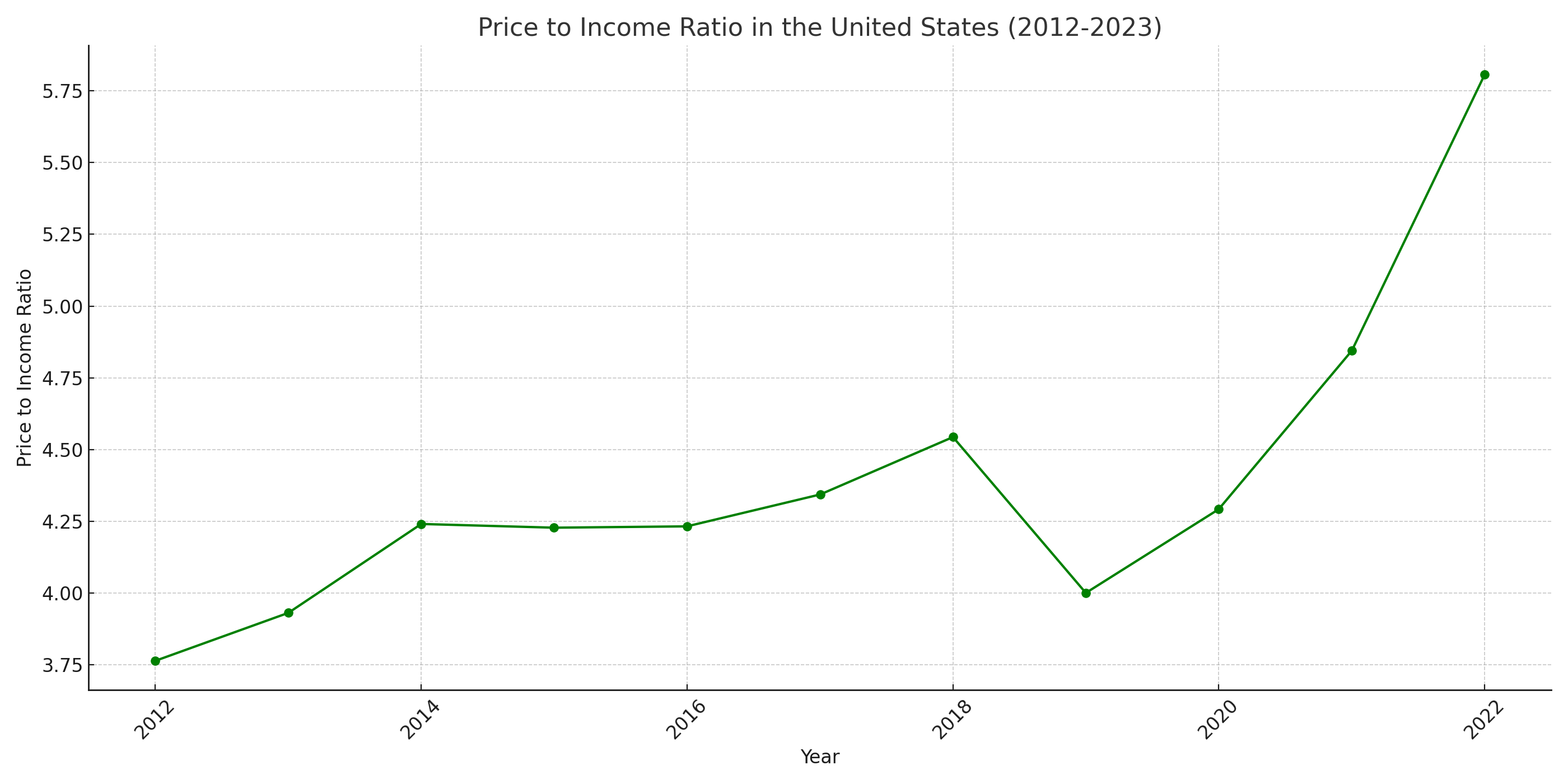

Recent data highlights the severity of this issue. The median house price in the U.S. has more than doubled over the last two decades, while median household income has grown at a much slower rate. This has pushed the dream of homeownership out of reach for many, particularly in urban areas where the disparity is most pronounced.

The consequences of this widening gap are profound, impacting not just the ability of individuals to purchase homes but also affecting economic mobility, wealth inequality, and the social fabric of communities. Addressing this issue requires a multi-pronged approach, including policy reforms aimed at increasing the supply of affordable housing, improving wage growth, and curbing speculative real estate investments. Only through comprehensive action can we hope to bridge the growing divide between house prices and income, ensuring that the American dream of homeownership remains accessible for future generations.

Thanks for reading,

Chris