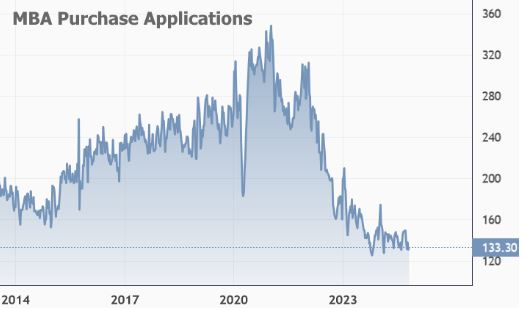

In recent months, mortgage applications have hit their lowest levels since 1995. This is a significant trend that underscores how rising interest rates and economic uncertainty are impacting the housing market. For prospective buyers, this decline may seem alarming, but it also presents unique opportunities.

The reason behind this drop is primarily tied to high mortgage rates, which are discouraging many buyers from entering the market. With rates hovering near multi-decade highs, fewer people are willing or able to take on new loans. As a result, the number of mortgage applications has steadily decreased.

However, this slowdown in demand could actually work to a buyer’s advantage. With fewer competitors in the market, those who are prepared to secure financing may find less bidding pressure and potentially more favorable home prices. It’s a classic case of supply and demand: fewer buyers mean sellers may be more willing to negotiate.

If you’re considering buying a home, it’s essential to focus on what you can control. Make sure your credit score is in good shape, save for a strong down payment, and get pre-approved for a mortgage. This will put you in the best position to act quickly when the right property comes along.

Despite the headlines about low mortgage applications, the market is always shifting. Being prepared and informed can help you navigate these changes to your advantage. In times like these, working with a knowledgeable realtor can make all the difference in finding the best deals available.

Thanks for reading,

Chris