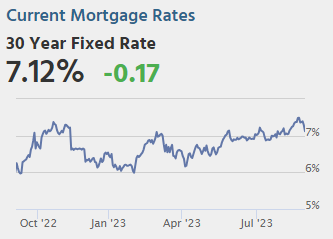

Mortgage rates continue to rise and currently sit at 7.12% according to Mortgage News Daily.

Here is an overview of where we stand today:

- Mortgage applications rose in the latest week, even though rates stayed the same.

- This is because some buyers have accepted the higher rates, and others are buying now because inventory is low.

- The average 30-year fixed mortgage rate was 7.31%, unchanged from the previous week.

- The purchase index rose 2%, and the refinance index rose 2.5%.

- The mortgage market is still uncertain about the Federal Reserve’s plans to raise interest rates in the near term.

- However, some buyers seem to have accepted the higher rates and are moving forward with their home purchases.

- Others are buying now because inventory is very low, and they are willing to pay higher rates to get the home they want.

- The average 30-year fixed mortgage rate is still significantly higher than it was a year ago, when it was around 3%.

- This means that monthly mortgage payments will be higher for borrowers who take out a mortgage today.

With all of this said… the housing market remains strong, and demand for homes is still outpacing supply.

Thanks for reading,

Chris