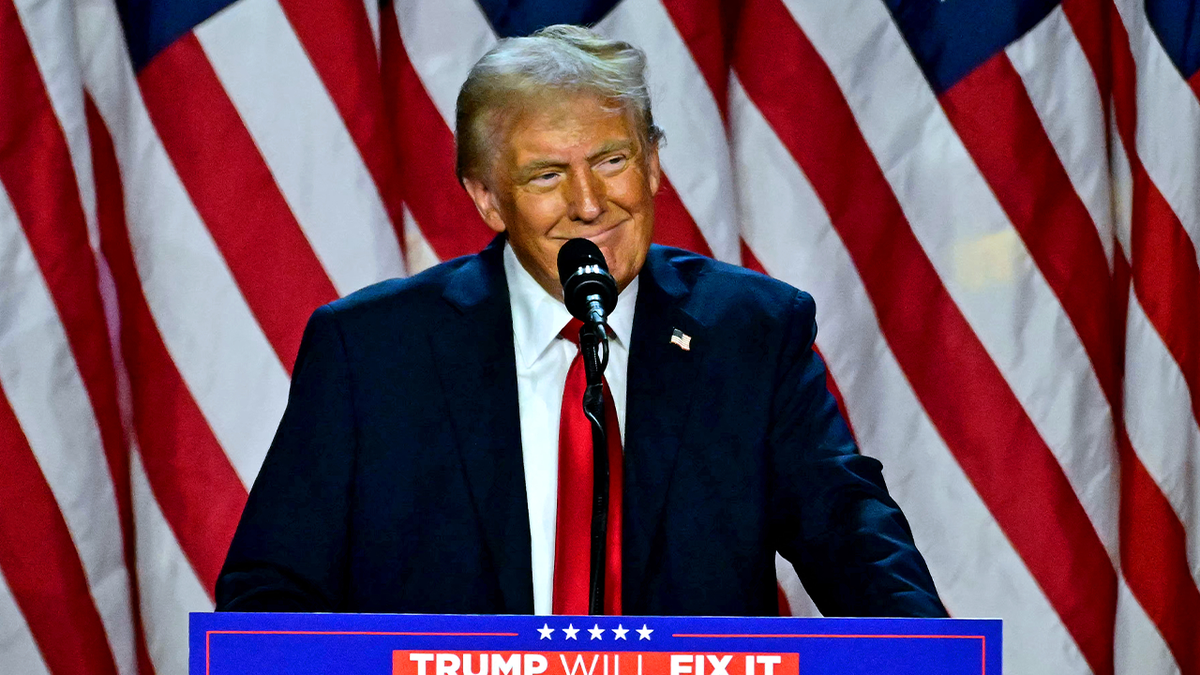

Donald Trump’s victory in the 2024 presidential election is set to have significant impacts on the real estate market. Here are five key implications to watch:

1. Potential for Deregulation

Trump’s previous administration focused heavily on deregulation, and we can expect this trend to continue. This could lead to more lenient building and zoning regulations, potentially increasing the housing supply. Reduced regulatory burdens on developers may encourage new construction, helping to address the ongoing housing shortage in many parts of the country.

2. Economic Stimulus and Housing Demand

Trump’s economic policies often emphasize tax cuts and business incentives. These measures could boost economic growth and, consequently, housing demand. Increased disposable income resulting from tax cuts may benefit the housing market by raising demand for homes, potentially leading to a short-term boost in housing prices.

3. Interest Rate Uncertainty

While the Federal Reserve controls interest rates, Trump’s influence on economic policies could indirectly affect them. There have been discussions within his campaign about restructuring the Fed to exert more direct control over rate decisions. This could lead to lower rates to stimulate the economy, but it might also introduce economic uncertainty.

4. Impact on Foreign Investment

Trump’s “America First” policy could have mixed effects on foreign real estate investors. While some countries might face restrictions, it’s unlikely that Trump will take a strong stance against foreign investments in general, given that non-resident investors purchase about $60 billion in residential real estate annually.

5. Potential Market Volatility

The anticipation of a Trump presidency has already impacted mortgage rates, with some economists predicting higher inflation under his administration. This could lead to market volatility in the short term as investors and homebuyers adjust to new economic realities. As the new administration takes shape, real estate professionals and investors should stay informed about policy changes and market trends to navigate this evolving landscape effectively.

Thanks for reading,

Chris